The coronavirus (COVID-19) pandemic has accelerated digital transformation across enterprises resulting in the rapid adoption of data and analytics.

As a result, it has triggered a wave of activity for Fobi AI (TSX-V:FOBI, OTCQB:FOBIF) Inc, a company that provides real-time data analytics through artificial intelligence (AI).

The Vancouver-based data intelligence company’s unique Internet of Things (IoT) device - Fobi - provides real-time insights, analytics, and visibility into buying trends. It provides data applications in real-time that enable retailers to improve operational efficiencies with automated supply chain and inventory management tools.

“We’ve seen nearly 20 years’ worth of digital transformation over the last two years. We are working alongside clients every day to bridge the gap between the online, the in-store and now mobile commerce,” Fobi founder CEO Rob Anson told Proactive.

A consummate technologist, Anson looks at the world with the eyes of a disruptor. “A disruption shakes things up and produces something new and more efficient. We are redefining how the world conducts itself through real-time data analytics,” said Anson.

Anson has a track record of success, turning media and technology startups into great businesses through strategic acquisitions and innovation.

Fobi 3.0 on Amazon Business

The pandemic has walloped the global supply chain, but Anson has secured key chip components to deliver the latest version of the company’s IoT hardware, Fobi 3.0, which will offer even more functionality for retailers.

“We are now set to roll out our Fobi 3.0 IoT devices globally in the first quarter of 2022 and anticipate a record-breaking year. We've got hundreds of retail opportunities looking to deploy Fobi 3.0,” noted Anson. “We’ll be shipping from our factory directly to Amazon's regional distribution warehouses and Amazon will ship all our hardware worldwide for us.”

In a nutshell, the upgraded Fobi 3.0 device integrates seamlessly with any point-of-sale system or customer data platform in minutes. If a company has an existing loyalty program Fobi’s IoT device can also enable loyalty redemptions right at the point of sale.

The Rise of Digital Wallets

At its heart, Fobi AI (TSX-V:FOBI, OTCQB:FOBIF) is a data intelligence company, but Anson was quick to see the rise of digital wallets. The ability to make calls is sometimes merely a footnote on a smartphone that acts as everything from a camera to an entertainment hub — and now a digital wallet.

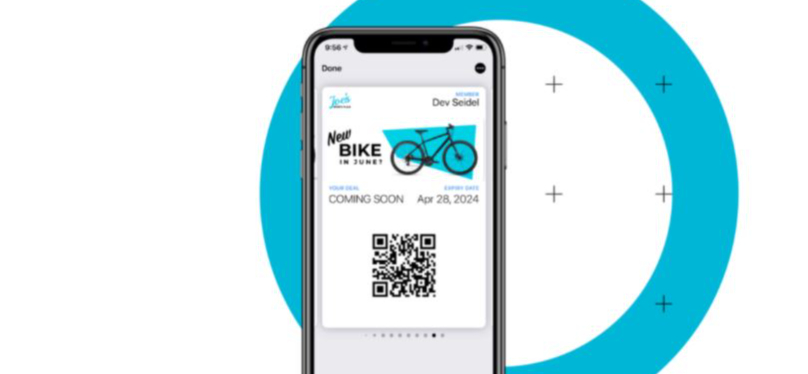

Passcreator by Fobi helps businesses engage customers, right in the mobile wallet that’s pre-installed on every Apple and Android device. Passcreator helps businesses to create, customize and validate mobile wallet passes for everything from digital coupons, reward cards, and event tickets to ID badges.

“I made a pretty big bet on the way the world was going in regard to digital wallets two and a half years ago,” pointed out Anson. “For us, the wallet pass business is doing extremely well and has enabled us to create several microservices including our digital proof of vaccination service CheckVax and our venue management solution.”

In November, Fobi signalled its up-and-coming position as a leader in the digital wallet space by completing the acquisition of Android wallet pass issuer PassWallet from Quicket GmbH in an €888,000 (US$1.03 million) cash and share deal.

Anson said there’s been a significant increase in downloads of the PassWallet app to 7.28 million from 6 million, with the biggest gains coming from Europe including Spain, Germany, the UK, Romania, and Bulgaria.

Due to the demand for contactless, cashless, mobile transactions, the digital wallet market will snowball to $46 billion by 2028, from $11 billion in 2020, clocking up an 18.9% compound annual growth rate, according to a report by Research Drive.

Acquisition Hungry

Anson has turned to mergers and acquisitions to fuel the company’s growth. Key acquisitions for Fobi over the past year include coupon and advertising platform Qples Inc., a deal that gives Fobi control over a connected retail commerce solution. Qples’ technology has been integrated into Fobi’s connected retail commerce solutions and the Fobi Data Exchange. The business is cash flow positive and expected to generate US$1 million in revenue in 2021, and hit $2 million this year, according to Fobi.

Anson sees acquisitions as a way to solidify Fobi’s dominant position in the wallet pass industry.

“We've already made five acquisitions in 2021 and just completed the integration of those companies,” said Anson. “I see us as a SaaS company, a service company and a high-growth company. For us, M&A will continue to be a big part of our global dominance, especially in the wallet pass space,” said Anson.

Fobi’s M&A activity is anchored by its healthy balance sheet and cash which grew to $8.27 million in November, thanks to 5.27 million warrants which were exercised for $1.8 million.

Scoring Contracts

Fobi is off to a strong start this year by signing a $300,000 annual license wallet pass deal with an auto-renewal with one of the world's top insurance providers. It will earn monthly recurring revenue through this deal from an annual license fee, as well a license fee for each wallet pass issued.

The Fobi Passcreator Wallet pass platform will allow the insurance provider to issue digital proof of insurance passes for both auto insurance and general insurance across five countries in Europe. “This deal solidifies our position as a leading digital wallet pass provider with three of the Top 10 global insurance companies now leveraging Fobi to deliver digital and verified proof of insurance,” said Anson.

Fobi earlier won a $240,000 data consulting agreement with Kiaro Holdings Corp to consult on the development of the cannabis retailer's data warehouse and data analytics strategy. Fobi will assist Kiaro by introducing the use of AI applications and data mining techniques.

The contract comes on the heels of a $250,000 agreement with Azincourt Energy (TSX-V:AAZ) Corp to help transform legacy, antiquated, but commonly used practices in the mining and exploration sector, to help Azincourt achieve more impactful drill holes in less time and with less cost.

“We are a data analytics company at heart,” said Anson. “The industry diversity of our two data consulting clients - from energy exploration to cannabis retailing - demonstrates the versatility of Fobi’s AI Data Intelligence.”

Eyeing Nasdaq

Fobi is looking to move pilot projects to recurring revenue contracts and is in multiple advanced-stage discussions with potential clients in North America and Europe.

“There are a lot of pilots we’ve done that are converting to contracts this year,” said Anson. “While others have struggled, we’ve made five acquisitions in 2021 and released seven products.” That’s a result of Anson’s vision and then the execution by Fobi CTO Tamer Shafik and the engineering team which has swelled to over 50 developers.

Anson, who is known for working 15 to 18 hours a day, is exploring uplists to major exchanges.

“We definitely want to uplist. We expect the share price to rebound and put us in that position to benefit and successfully achieve our Nasdaq listing organically,” said Anson. “We had our biggest month in December and have a jampacked pipeline. I’ve conveyed patience to the market — this is an investment, not a trade. But with the realization of revenue in the last three quarters, we’ve seen growth and 2022 will be a record-breaking year for Fobi. We are just getting started.”

Anson has put his own money where his mouth is by investing over $800,000 in Fobi over the past two years.

This blog post was originally published on Proactive

Contact the author Uttara Choudhury at uttara@proactiveinvestors.com

Follow her on Twitter: @UttaraProactive

.png?width=50&height=50&name=Brand%20Mark%20(With%20Background).png)

January 14, 2022